Investor Concerns Echoed by Mounting Advisor Pessimism Amid Turbulent Economic Conditions

New findings from Escalent reveal tariffs, geopolitical events, government actions, and stock market volatility at the forefront of advisors and investors’ worries

LIVONIA, Mich., July 23, 2025 (GLOBE NEWSWIRE) -- In today’s rapidly changing market and economic landscape, financial advisors are faced with making high-stakes decisions on behalf of their clients. As they navigate economic shifts and uncertainty, advisors' general satisfaction with U.S. economic conditions has declined sharply, with 38% saying they are either ‘not at all satisfied’ or ‘not very satisfied’ compared with just 23% who are satisfied or very satisfied.

These are the latest findings from Cogent Syndicated's Monthly Sentiment Tracker™ report. This monthly report monitors trends in advisors’ and investors’ sentiment about the market, economy and investment environment. The report also tracks current satisfaction with and future views on the economy, along with concerns that affect investment decisions.

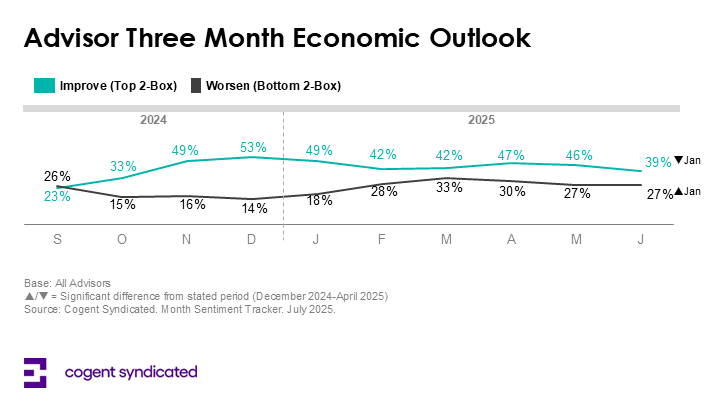

At the end of June 2025, over one-quarter (27%) of advisors indicated that they expect the economy to worsen over the next three months—a feeling that has risen sharply since the end of last year along with a decline in optimism. In revealing their leading concerns, advisors identified issues such as tariffs impacting profits and stocks (45%), geopolitical events (40%), government decisions (36%), and stock market volatility (32%).

Similarly, investors are largely pessimistic about the current and future state of the economy with more than half of investors (54%) expressing dissatisfaction with current economic conditions, and the number of investors who believe the economy will deteriorate over the next three months has surpassed those who believe it will improve highlighting the uncertainty within the U.S. at this time. Investors' concerns remain closely aligned with those of advisors with the impact of tariffs, government actions, increase in inflation and stock market volatility at the forefront. Investors showed spikes in anxiety, fear and depression in April which then subsided in May, but reemerged as of June – showing how volatile and emotionally charged the current environment is in the U.S.

“With ongoing changes at the federal level continuing to impact the global economy, and further volatility anticipated, it's important for wealth management firms to stay on top of these rapidly shifting dynamics now more than ever,” said Linda York, a senior vice president in Escalent’s Cogent Syndicated division. “This data affirms that actions of investors over the past few months have not been unjustified, and advisors are also feeling pressure to make adjustments in their strategy as they assess and navigate the impact of tumultuous conditions."

Changes in sentiment and satisfaction are reflected in advisors’ expected usage of various asset classes. More than one in four advisors expect to increase their focus on actively managed non-U.S. equities, while one-third plan to increase their exposure to active U.S. equities, to drive future growth. At the same time, they expect to reduce their allocations to passive non-U.S. and emerging markets debt. Private equity is the favored alternative asset class, with 14% planning to increase allocations while real estate and real assets are expected to slip. However, despite their overall mounting concerns, 50% of advisors remain bullish, signaling that they remain optimistic in their market outlook.

To learn more about Monthly Sentiment Tracker™, visit escalent.co.

About Monthly Sentiment Tracker™

Affluent investor data for the Monthly Sentiment Tracker is sourced from a monthly online survey conducted among affluent investors, defined as individuals aged 18 or older who are sole or joint financial decision-makers in their households and hold at least $100,000 in investable assets (including retirement accounts, excluding real estate). Investor population figures are weighted to align with U.S. Census demographics. Advisor insights reflect responses from professionals managing $5 million or more in assets under management (AUM) and who offer investment advice or planning services to individual investors. Figures are weighted to be representative of the Discovery database of registered financial advisors. For the June reporting period, base sizes were 3,633 for investors and 551 for advisors.

About Escalent

Escalent is an award-winning data analytics and advisory firm specializing in industries facing disruption and business transformation. As catalysts of progress for more than 40 years, we accelerate growth by creating a seamless flow between primary, secondary, syndicated, and internal business data, providing consulting and advisory services from insights through implementation. We are 1,600 team members strong, following the acquisition of C Space and Hall & Partners in April 2023. Escalent is headquartered in Livonia, Michigan, with locations across the U.S. and in Australia, Canada, China, India, Ireland, the Philippines, Singapore, South Africa, UAE and the UK. Visit escalent.co to see how we are helping shape the brands that are reshaping the world.

CONTACT: Kim Eberhardt

248.417.2460

keberhardt@identitypr.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5131afd9-7dc3-432f-a4e4-27e10c877b4a

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.